Tilden Path Capital invests for the long run in select, well-researched small tech companies emerging as winners in sectors being disrupted. Such companies have superior products, and have durable competitive advantages, allowing them to grow for the long term. One of the examples is Arista Networks which has returned 1331% returns since we first made the investment in 2014. In comparison, as of Oct 17, 2023, S&P 500 has returned 111%.

It’s important to recognize the value of luck – investing inherently has a random element. That said, it’s also important to understand the decision process that made this investment successful - 1) Enterprise Network switching market was at an inflection point due the advent of Cloud and Web 2.0, 2) the major incumbent (Cisco) was big and slow and had less incentive to innovate as most of their business came from the traditional datacenter, and 3) Finally Arista had a great product for the Cloud and had a superior engineering team which allowed them to keep innovating and retain market leadership.

What were the reasons to invest in Arista Networks?

Arista Networks started in 2008 as an upstart in the market of network switches - which was dominated by Cisco. A network switch is a hardware device that connects devices on a computer network by helping receive and forward data. We discuss the reasons which made this a great investment.

1. Advent of Public Cloud presented an inflection point, driving need of a new product

The public cloud phenomenon started in 2006 when Amazon launched AWS, a utility like approach - now enterprises could run their computing workloads on the cloud vs operate their own enterprise data centers. This new approach meant that customers needed a new product. Arista focused on switches that shuttle Internet traffic using the 10 Gigabit Ethernet standard, vs the 1 Gigabit Ethernet standard that dominated data centers at the time. Arista’s products were built for the cloud and superior in factors of scalability, low latency and resilience.

Bigger Scale

The cloud operated at a bigger scale vs the traditional data center - if we think of the public cloud as a utility for 100s of companies, it required 50,000 to 100,000 servers vs ~1000 for a traditional data center. Also, web 2.0 companies (social networking, search engines) adoption of server virtualization meant a physical footprint of 100,000 servers translated to 1M virtual machines. Suddenly the network was the bottleneck and this required new network switches.

Low Latency

Back in 2009, the focus of applications like high frequency trading was shaving off every microsecond with a goal of end to end latency of 25 microseconds. Here, Arista talks about reducing latency for network switches to less than a microsecond vs a Cisco network switch which added ~5 ms. In 2009, Arista got 30% of their revenue from financial services. As an aside, financial services is often an early adopter, and was a good example that Arista had crossed the chasm.

Self-Healing Resiliency

The resilience in the cloud was more important as the scale was much bigger. Arista’s innovative software approach was based on their EOS (Extensible Operating System) which was based on open standards and used a software approach for self-healing resilience (details here)

2. The Incumbent had little incentive to innovate for the new market

Cisco was focused on the traditional data center, a big market, and they had less of an incentive to develop a new product for the cloud, still a nascent market - (similar story played out with software vendors like Oracle and the cloud). Here is Arista’s CEO in 2013: “Cisco in my view will always be the enterprise market leader. Arista is inspired and aspires to be the cloud networking leader and be a complement to Cisco’. This Quora thread documents reasons why Cisco was big and slow to innovate.

3. There was a large Total Addressable Market (TAM).

Arista’s S-1: “We compete primarily in the data center switching market for 10 Gigabit Ethernet and above, excluding blade switches. According to Crehan Research, this market will grow from approximately $6 billion in 2013 to $12 billion in 2017, representing a 19% compound annual growth rate”

What durable competitive advantages made this investment a long-term winner?

It is not impossible to find companies who do well for one-three years but there are fewer companies which have durable advantages. Warren Buffett talks about durable competitive advantages for companies like American Express, here we cover the same for Arista

1. Protection from Competition (aka Barriers to Entry)

Certain software products are inherently harder for copy for competitors. Building a network switch which has low latency, a significant price/performance advantage, is a lot tougher to replicate vs building a food delivery app. Arista was able to build a superior product mainly because they had superior engineering talent - founders include Andy Behctelsteim, one of the founders of Sun Microsystems, and David Cheriton, a Stanford professor. This allowed allowed them to be the best in class in successive classes of switches from 10GBe to 100GBe, 250GBe and now 400GBe.

2. Switching costs

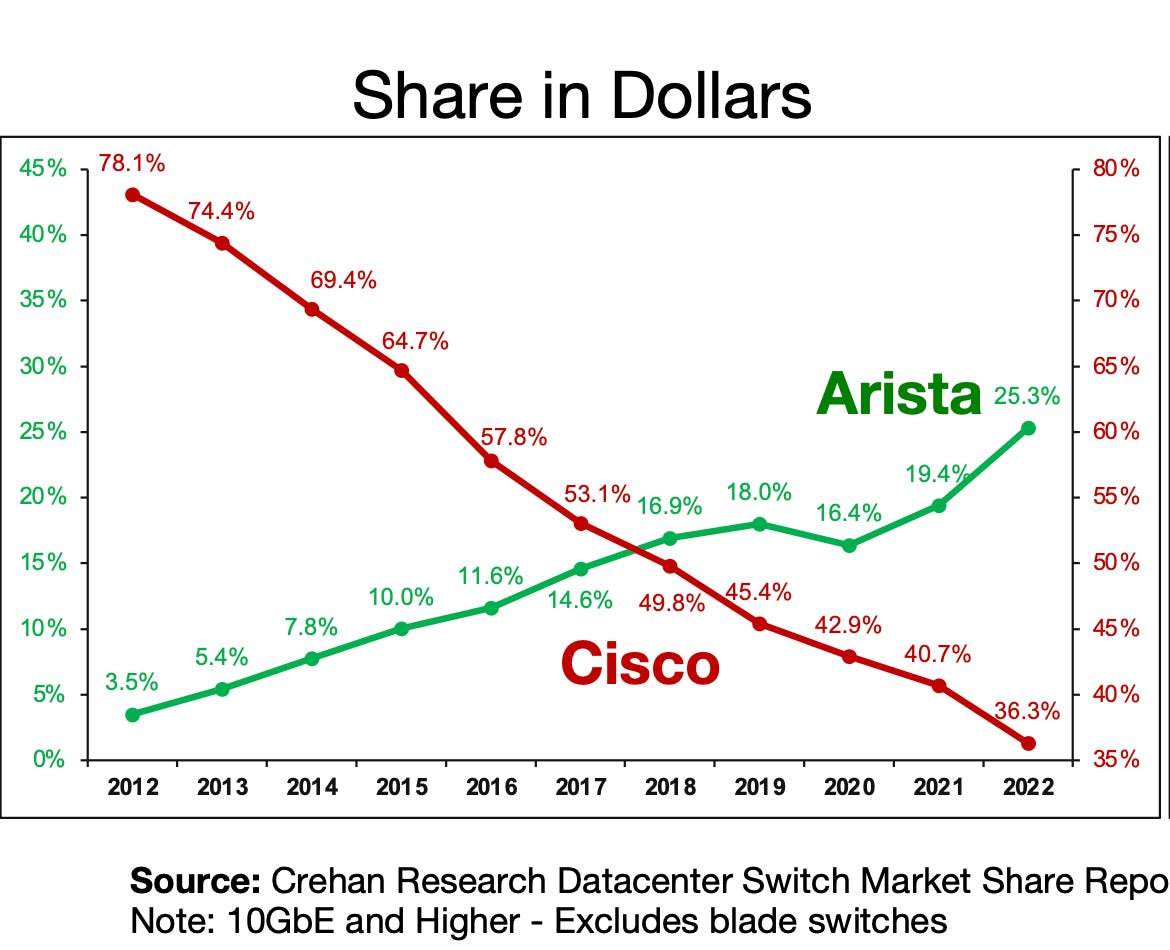

Network switches have high switching costs. Once Arista’s customers like Facebook and Microsoft adopted Arista’s network switches, they have made a significant investment in the learning and training costs and also testing intercompatibility between the network switches and the other software and hardware in their data center architecture. The above graph from Arista’s investor deck shows the impact of high switching costs in switches, even though Arista’s switches were better than competition in 2012, it took ten years for Cisco to lose half of their market share.

3. Price/Performance Advantage

Enterprise B2B products that win in the long term also have a price/performance advantage. The founder Andy B. documents the performance advantages in this blog as he talked about the 10GBe switch in 2019 ‘The Arista 7500 improves every single metric in the data center modular switching category by factors ranging from 3X to 10X’. This blog by him about the 400GBe switch talks about how they have maintained their price performance advantage.

Finally, the purchase was made at a reasonable valuation

At the time of the first purchase (Dec 2014/Jan 2015), Arista had an annual revenue of 581M in 2014, with a market capitalization of ~4B. The company which was GAAP profitable, with 80% Gross Margins and 11% Net Income margins. Looking at the valuation ratios, it was valued at Price/Sales of ~7 and a Price/Earnings ratio of 59.

But at the moment, the company was growing at ~60%, was the market leader and had a total addressable market. According to its S-1, The company’s revenue had grown from 71M in 2010 to 361M in 2013, a 62% CAGR, and the number of customers had increased from 570 in 2010 to 2340 in Dec 2013. Arista already had customers like Microsoft (responsible for 10% of revenue), Facebook, VMWare, Yahoo, Comcast and Citigroup. The company had discovered product market fit, had leading customers, and had less than 10% of the high end switch market, which was projected to grow from $6B in 2013 to $12B in 2017. It seemed highly probable that investment would be a profitable one.

Should one hold a winning investment forever?

None of the shares purchased have been sold since purchase. The reason being that the market is still growing, currently Arista estimates a TAM of $51B in 2027 (current revenue is $5.2B). As long as Arista continues to have a superior market and until there is another inflection point (AI may be?), it may be prudent to hold on to the initial investment.

The author, is an investment adviser representative with Tilden Path Capital, LLC, a registered investment adviser in California.

Past performance is no guarantee of future returns.

All investing involves risk and possible loss of principal.

In our analysis, we use third-party resources we believe to be reliable, but cannot guarantee the accuracy of such information. We believe the information we provide is accurate as of the date furnished, but we do not revisit past material to update it.