Toast’s Hidden Long-Term Competitive Advantage – Software Modules

$TOST

Toast is in the news as a rapidly growing point-of-sale (POS) system for SMB restaurants, with a 3yr CAGR of 60%. In contrast with competitors like Square, Toast is focused on just one vertical – restaurants – and this approach gives it a key advantage.

The majority of Toast’s revenue comes from processing transactions (82% as of Q1 2023), but it is gaining traction in also selling its customers software modules for payroll, inventory-management, and email marketing. Toast’s SaaS products are the hidden growth story, giving the company key competitive advantages that include high switching costs and increased efficiency for customers.

Tilden Path Capital believes that companies with superior technology products are more likely to win long-term in the market. We anticipate that Toast’s restaurant-only approach and focus on building an integrated platform (vs. integrating acquisitions) will create a bigger moat by providing a superior customer experience (and consequently higher switching costs). This is one to consider for long-term investors.

How do Toast’s vertical focus and software modules help its customers?

Efficiency and reduced need for manual work: Toast’s approach of building software that integrates all business workflows for a restaurant helps reduce the need for manual work. For example, Toast’s software links a POS ordering system to a Kitchen Display System for cooks. Similarly, Toast can generate payroll for their employees in minutes because Toast’s payroll is integrated with Toast’s scheduling.

Integrated technology stack (single vendor): Toast’s Cloud platform reduces the need for customers to cobble together a solution using multiple vendors, and Toast’s API-based approach has helped build a list of 100+ integrations. Restaurants who moved from Square to Toast have noted in local interviews that UberEats integration via Toast’s API reduces the need to manually record orders.

Leverage data as a competitive advantage to build better personalization: Toast’s platform approach enables data-sharing between Toast’s SaaS modules, allowing customers to deliver customized experiences – for example, creating loyalty coupons for their most frequent end-users.

How does this competitive advantage translate to growth and financial metrics?

Traditional growth levers

As of Q1 2023 Toast served close to 85,000 restaurants, growing 37% the previous year. However, Toast nonetheless has only 10% of the US restaurant market share, which offers room for considerably more growth. In addition to new restaurants, Toast is working on other growth levers including international growth in English-speaking countries (UK, CAN, IRE) and is also moving to the enterprise market (including a recent win at Marriott).

Growth levers based on SaaS modules

Increased attach rate of SaaS modules: Toast’s Q1 2023 earnings presentation notes that the number of locations using 6+ modules increased from 21% (Q1 '21) to 42% (Q1’23), demonstrating Toast’s ability to upsell.

Higher switching costs lead to lower churn: Point-of-sale platforms don’t have big switching costs and are generally decided on cost, but as restaurants adopt Toast’s SaaS modules, it increases switching costs.

Higher gross margins and future pricing leverage: Looking at their latest 10-Q, Subscription services have higher gross margins than payment processing (66% vs. 22% in Q1’23). Toast currently prices its software based on the number of modules offered, but in the future it could leverage other established SaaS models to increase pricing and revenue.

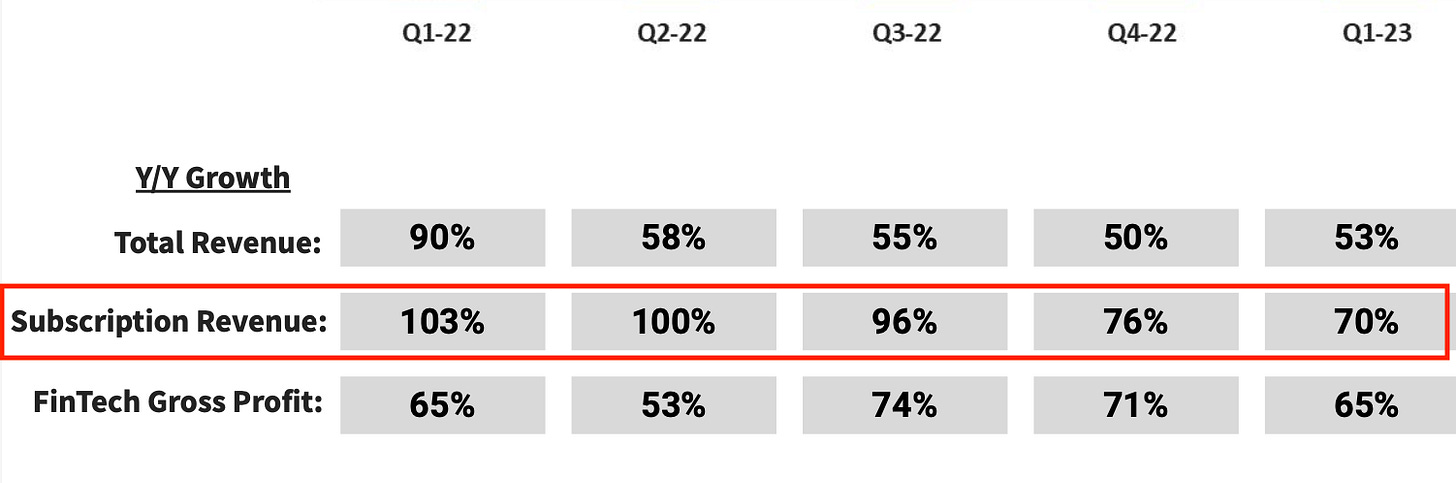

Toast’s subscription revenue is growing faster

Toast’s 3-year CAGR of 60% is already impressive, but it's subscription revenue, as depicted in their recent earnings presentation, is growing even faster.

Valuation

Here, we attempt a sum-of-parts analysis based on P/S multiples. Toast’s annualized payments revenue based on Q1 2023 (total revenue minus subscription revenue) is $2.85B. Taking peer P/S multiples (Square 2.4, Adyen 5.5, Lightspeed POS 3.61), we assume a conservative P/S multiple of 3 for Toast (Toast’s growth is faster than that of Square or Lightspeed POS).

As of Q1 2023, subscription services ARR is ~$428M (4*107M). Applying a 10 P/S multiple (conservative for fast-growth SaaS businesses), this business is worth $4.28B. A sum-of-parts approach values Toast at $12.85B, a 10% premium over its valuation as of July 21, 2023.

Tilden Path Capital's approach is to buy small and mid-cap tech businesses with industry-leading products for the long term, thus long-term investors might consider Toast.

The author, is an investment adviser representative with Tilden Path Capital, LLC, a registered investment adviser in California.

Past performance is no guarantee of future returns.

All investing involves risk and possible loss of principal.

In our analysis, we use third-party resources we believe to be reliable, but cannot guarantee the accuracy of such information. We believe the information we provide is accurate as of the date furnished, but we do not revisit past material to update it.

Great post!!! Really enjoyed reading your take on Toast's business model, competitive levers and valuation.