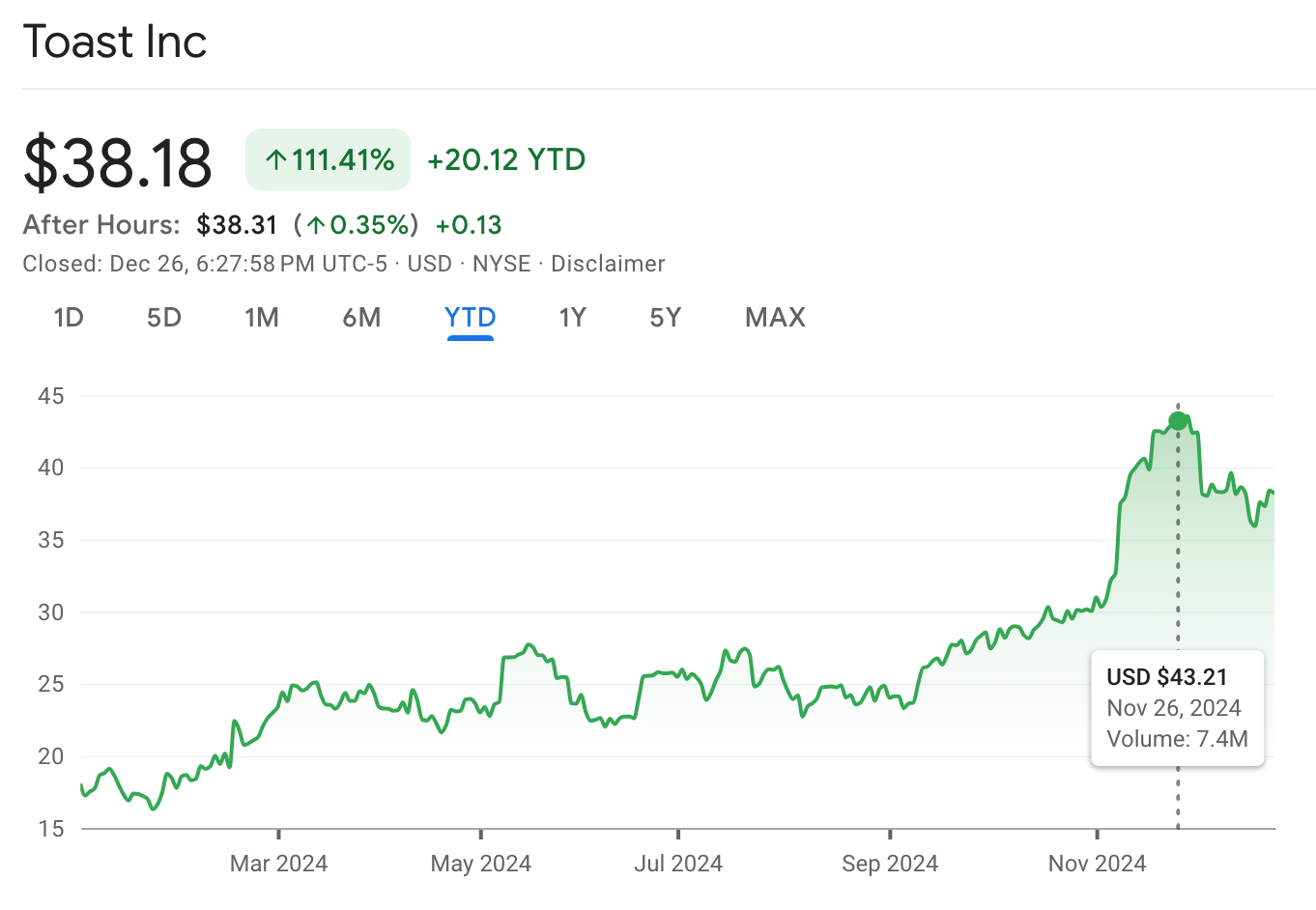

This is a follow-up from the earlier write-up on Toast on Substack from July 25, 2023. Finally, market is recognizing the value of Toast’s superior product and SaaS software, which is demonstrated in the 111.41% returns for the stock so far in 2024.

The write-up below was covered in Tilden Path Capital’s Q2 investor letter from August 15, 2024. The valuation model included in this letter was updated on Aug 1, 2024. Excerpt from the letter below.

Applying a conservative PE multiple range of 20 to 30 to our net income ranges of $1.35-$2.2B, we arrive at a range of valuation of $27-$66B in 2027 — an upside of 98%-280% from Toast’s current valuation of $13.57B. This valuation exercise was finalized on Aug 1, 2024.

Given Toast’s valuation is currently $21B as of Dec 26. 2024, Toast’s currently has less upside given the valuation exercise above. Also, this post is not an endorsement to buy or sell Toast stock.

Tilden Path’s investor letters are available here and one can subscribe to the future letters for free here.

Discussion of Portfolio Holding — Toast

Toast is a leading provider of SaaS solutions for restaurants, but the brand is probably better known as a point of sale (POS) system for SMB restaurants in the United States. Toast has a 3-year revenue CAGR of 67%, and has grown from 40k to 112k locations since 2021. Here, we first evaluate the company based on two of our proprietary Durable Growth Score factors, then cover its underappreciated growth factors, and finally present our valuation analysis.

Rating Toast on Tilden Path Capital’s Durable Growth Score

Protection from Competition (Durable Score Weighting: 25%, Score: 4/5)

This factor measures how difficult it is for another vendor to build a technology solution competitive with Toast.

Though Toast is widely seen as a POS device, behind that the company has built an impressive B2B ERP (enterprise resource planning) cloud solution to automate the entire business processes of running a restaurant: generating invoices, running payroll, managing inventory, organizing waitlists and tables, and more. ERP solutions are notoriously difficult to implement — for example, Salesforce can take from three months to more than a year. However, Toast’s well-architected solution gets a new restaurant up and running in 4-6 weeks. That Toast has built these solutions in-house, without relying on acquisitions (in comparison with their competitor Partech (link), speaks to the extensibility of its platform. Tilden Path’s research shows that Toast’s solution is well-architected and elegant and effectively solves the problem of automating the business process of running a restaurant, certainly a non-trivial task. The platform’s extensibility is demonstrated by its launch of 26 new modules of functionality since 2020 and its expansion into the adjacencies of international markets and food & beverage retail.

One example of Toast’s engineering prowess can be seen in its decision to build the POS on top of open-source Android rather than taking the easier route of employing Apple iOS. The more challenging path of customizing Android has allowed Toast to tailor POS form factors and to be more affordable for customers. Tilden Path values management that takes a long-term approach in building software systems, and rates Toast a 4.5/5.

High Switching Costs (Durable Score Weighting: 25%, Score: 4.5/5)

This factor measures how difficult it is for a customer to switch from Toast to a competitor.

Once an organization adopts Toast’s POS system with the accompanying software modules and trains its employees on them, it is very difficult to replace this functionality. These additional SaaS modules are popular, and 43% of Toast’s restaurants use at least six of them.

Our interviews over the past two years with restaurant employees and owners demonstrate that people love using Toast’s systems. We rarely find employees who love the technology system they are required to use at work. We believe that the qualitative strength of Toast’s platform is underappreciated, and this excellent customer experience contributes to the high switching costs. Tilden Path rates Toast a 4.5/5 in this category.

Other Factors of Tilden Path’s Durable Growth Score

Other Durable Growth Score factors for Toast include ecosystem strength (Weighting: 20%, Score: 4/5), price/performance advantage (15%, 3), and customer experience (15%, 4.5). Taken together, these result in a weighted average score of 4.05/5 — a top-quartile result.

Toast’s Underappreciated Growth Drivers

Before discussing Toast’s valuation, we talk about some underappreciated Toast’s growth drivers in the next few years.

Software Pricing Leverage in SMB and Enterprise

Toast has two primary revenue segments: fintech revenues (from processing payments), and subscription revenues (from software modules). Toast’s subscription SaaS revenue grew from 9.9% to 13% of total revenue between 2021 and 2023, with 67% gross profit margin.

Conventional wisdom is that SMB restaurants operate on tiny margins and so are price-conscious and will switch to a competitor on price. Toast’s current pricing for Digital Storefront Pro which includes POS, Online Ordering and Website costs $149 per month, which compares favorably with Square’s Premium package for Restaurants at $165/month.

Not all of Toast’s restaurant clients have small margins, however, and some seem ready to pay up for software. Management commentary during quarterly calls has mentioned increasing prices at a moderate level for existing customers, but Toast has increased SaaS list prices for key modules by 50% for new customers between 2020 and 2023 - without impacting >20% growth. Though average annual SaaS revenue per restaurant was ~$5400 in 2023, more than 14% of Toast’s customers pay over $10k in annual SaaS revenue- this number was 2% in 2021.

Toast’s integrated cloud SaaS solution not only provides a superior user experience but also saves time for restaurant owners because of connected data flows across modules. For example, Toast Tips Manager syncs pooled tips from the POS directly with Toast Payroll. These SaaS modules also provide considerable value — a restaurant using HubSpot Marketing will be paying ~$10k per year, while Toast offers several modules (payroll, loyalty marketing, inventory, online ordering) estimated for ~$10-$15k. Thanks to the launch of new modules, potential annual SaaS revenue for a single restaurant has increased from $20k in 2021 to $30k in 2024.

Toast’s founders also understand the enterprise market well, given that their previous venture Endeca (acquired by Oracle) focused on search for enterprises. Toast is gradually penetrating enterprise clients, including Marriott, and an enterprise client generally spends considerably more than $10k annually per restaurant on technology, allowing Toast additional pricing leverage for enterprises. Marriott, for example, plans to spend a billion dollars on tech this year, which averages to a $125k annual spend each over their 8000 locations.

Tilden Path’s hypothesis is that Toast is following a “land and expand” strategy, starting with lower SaaS pricing to capture market share while it builds its SaaS software suite. Our estimate is that Toast will be able to increase average annual SaaS revenue per restaurant to at least $8k annually within three years, and to $12k-$15k within five years.

New AI Solutions Enabled by Toast’s Rich Restaurant Data

The initial productivity gains from generative AI benefit customers who use it for composing emails, drafting presentations, or creating marketing campaigns. Good content-generation AI depends on well-modeled datasets, and our belief is that SaaS companies focusing on a particular vertical, like Toast with restaurants, have an advantage here.

As an example, a horizontal POS, will model data for a sale/customer or a marketing campaign generically to be extensible to all verticals, and thus its data may not have the added context/labeling in their data to create a personalized marketing campaign for a hair-salon customer versus a grocery customer. In comparison, Toast focuses only on restaurants and further codifies the entire business process of a restaurant — resulting in clean, well-modeled, well-labeled datasets focused on restaurants and more suitable for AI. Toast’s customers therefore needn’t spend money and resources to prepare their datasets for GenAI, as Toast’s software creates clean and well-labeled datasets for every business workflow they use Toast for. Vertical SaaS companies will be able to generate better content and to create better-targeted marketing campaigns because LLMs trained or fine-tuned with their data offer more accurate and personalized answers and fewer hallucinations. Toast is already leveraging its rich data for projects ranging from creating personalized marketing campaigns to making localized menu recommendations for restaurants.

Expansion into Other Verticals and Other Adjacencies

Toast currently has 13% share of the US restaurant market (total possible US market: 875k locations), allowing it a long growth runway. Toast is also expanding to food & beverage retail (total possible US market: 220k locations), an increase of 25% to current TAM. Additionally, Toast has started to expand internationally in Canada, the UK, and Ireland, a further increase of 30% to its total TAM. Finally, Toast has expanded into lending with Toast Capital. All of these efforts are increasing Toast’s growth prospects.

Risks

The biggest risk to Toast’s growth story is the potential inability to expand its footprint because of the competitive nature of the restaurant industry. Toast’s most credible competitor, Square, is currently more focused on becoming the financial marketplace (Afterpay, Cash App, Bitcoin), which allows Toast to continue innovating at a faster pace for restaurants. Another risk is that macroeconomic conditions could worsen and lead to restaurant closures, which would also reduce Toast’s growth.

Valuation

Toast’s revenue growth rates are impressive, with a 3-year rate of 61% and YoY rate of 36% as of Q1 2024. Toast is a relatively low-gross-margin business with a majority of revenue from payment processing. As SaaS becomes a bigger portion of revenue (13% in 2023), however, gross margins have improved — from 18% in 2021 to 22% in Q1 2024. The gross profit margin of Toast’s SaaS revenue was 67% in 2023, 41% of Toast’s total gross profit.

In May of 2024 on Toast’s investor day, management guidance indicated a continued reduction of operating costs as a percentage of recurring gross profits (reduced from 96% in 2022 to 80% in 2023), and the goal of reduction in stock-based compensation from 35% in 2021 to low teens as a target in the medium term. Toast also conducted a 10% workforce reduction in 2024, which Tilden Path estimates will reduce its sales and marketing (S&M) and research and development (R&D) budgets by 6% in 2024 over 2023. We therefore estimate that operating costs will either decrease or be flat in 2024. This focus on efficiency has led to improvements of 2200 basis points in net margin over the past three years. Management is guiding to less than 2% annual share dilution in 2024 and beyond, signaling a focus on shareholder interests.

Our base case takes a conservative approach of adding 25k locations between 2024 and 2027 (an 18% 4-year CAGR), with a 10-11% annual increase in SaaS pricing, an 8-9% annual increase in S&M, and a 5% annual increase in R&D and G&A, from which we arrive at a $1.3B net income in 2027. Assuming a faster growth of 25% in locations and 15% increase in SaaS pricing, we estimate $1.35B net income in 2027. We use management projections of future SBC and operating costs in our estimates.

Applying a conservative PE multiple range of 20 to 30 to our net income ranges of $1.35-$2.2B, we arrive at a range of valuation of $27-$66B in 2027 — an upside of 98%-280% from Toast’s current valuation of $13.57B. This valuation exercise was finalized on Aug 1, 2024.

We also believe that Toast’s extensible platform will allow it to expand to other adjacencies like food & beverage without huge spending on R&D. Toast’s high Durable Growth Score supports our belief that Toast is well-positioned to grow >15% consistently for several years as it expands into current and future markets.

Our first purchase of Toast stock was at ~$20, and we added to our position at ~$15. We intend to hold unless Toast’s competitive position drops as evaluated by Tilden Path’s Durable Growth Score.

Estimates for Our Base Case (all numbers in GAAP, 2024 and beyond are estimates):

If you wish to discuss any information covered in this letter, please feel free to contact me at infoATtildenpathcapital.com.

The author, is an investment adviser representative with Tilden Path Capital, LLC, a registered investment adviser in California.

Past performance is no guarantee of future returns.

All investing involves risk and possible loss of principal.

In our analysis, we use third-party resources we believe to be reliable, but cannot guarantee the accuracy of such information. We believe the information we provide is accurate as of the date furnished, but we do not revisit past material to update it.